As more Kiwis tap to pay, offering contactless payments (also called an “NFC payment”) isn’t just convenient—it’s a smart move for your business. It speeds up transactions and gives your customers and your business the upper hand in flexibility.

Kiwi businesses have seen a surge in contactless payments, thanks to their convenience, speed and "hands-off” nature. Adoption has especially increased since the pandemic. Contactless transactions have grown by 62% in the past five years, and a recent survey shows that they make up nearly 40% of all transactions.

Contactless payment is designed with layers of security and advanced encryption to keep transactions secure and reliable. Here's why you can trust contactless payments:

Tap into the ease of contactless payments—accept funds with a simple hover of an NFC-enabled card or device on the terminal.

In New Zealand, contactless payment is a hit, with favourites like Visa's payWave and MasterCard PayPass leading the charge.

Embrace digital convenience with mobile wallets like Apple Pay, Google Pay and Android Pay, allowing customers to tap and pay with their phone or smartwatch.

Give your customers more ways to pay and gain the upper hand with contactless payments.

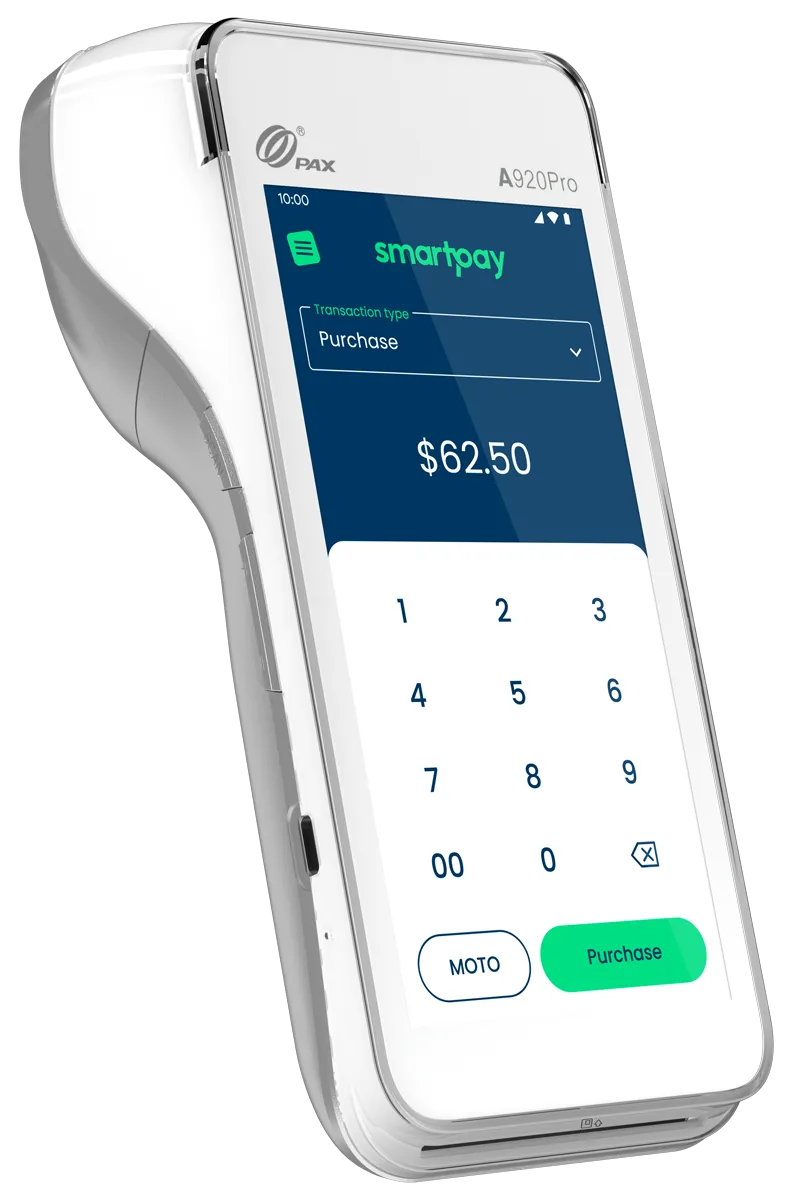

Getting started with contactless payments is a breeze with Smartpay! Here’s a simple guide on what to do to get set up:

Don’t have a Smartpay terminal yet? No worries! Get in touch with us to explore your options.

Everyone loves contactless and wants to pay by tapping their card. We needed to provide this option, but the monthly bank fees were hundreds of dollars! Setting up a surcharge with Smartpay was easy. I could do it all on the phone. It has made such a big difference. We’re thrilled to see the reduction in bank fees and will be re-investing the savings

^ Source: Merchant Contactless Study’, Visa.

*Source: Annual Mastercard Survey, Mastercard.

In general, any business could benefit from the speed and flexibility of contactless payments. Retail stores, including supermarkets, find it enhances customer service. Fast-paced sales businesses like event booths, pop-up shops, food services like fast food, coffee shops, bars and clubs, can all benefit from moving customer queues quickly. Additionally, industries like hair & beauty, tourism and charities are just some examples that can leverage contactless for quicker and smoother payments, ensuring timely schedules.

Adopting contactless payments enhances customer experience by providing a faster, more convenient payment option. It streamlines transactions, reduces wait times and attracts customers seeking modern, efficient payment methods, ultimately boosting overall customer satisfaction.

Promote payments by displaying signage or a contactless symbol at your business indicating acceptance. Encourage contactless transactions and train staff to assist customers in adopting this convenient payment method. If you’re applying a surcharge, clearly display this at checkout using signage.

Accepting contactless payments incurs processing fees that are negotiated with your acquirer. iIf you’re on Low Cost Tap & Pay that’s us!. Low Cost Tap & Pay is designed to give you a really low acceptance rate, helping your business save on costs. Learn more about how this could be right for you here.

Credit card surcharging is applicable on payments made on Visa, Mastercard, UnionPay AMEX, Diner and JCB cards. If the customer inserts/swipes their credit card and chooses the “credit” option, the programmed surcharge will apply.

Contactless surcharging is applicable on payments with any NFC enabled card or device. The card is not inserted or swiped in the terminal and, if the transaction is below $200 a PIN is not required for authorisation of the payment. These include all cards and devices with payWave (Visa), Tap & Go (Mastercard), Apple Pay and Google Pay.